Bree is redefining inclusive lending in Canada. Powered by Flinks’ financial data API, Bree approves and delivers lines of credit in under 10 minutes, right when it matters most.

{{keytakeaways}}

Serving overlooked Canadians with speed and care

Established by two Canadian founders, Bree is a Canadian fintech platform offering fast, no-risk lines of credit to individuals living paycheck to paycheck. Because Bree does not conduct credit checks, it is able to serve many Canadians often overlooked by traditional banks.

The product is simple: a frictionless line of credit to help cover rent, groceries, transportation, or emergency bills.

“With over half of Canadians living paycheck to paycheck, our mission is to help people when they need it most,” said Holly, Chief of Staff at Bree.

The bottleneck: Manual processes blocked growth

In the very early days, Bree’s application process required users to download and email PDF bank statements, each one reviewed manually by a team member. It was slow, unscalable, and unsustainable.

“It required a human to go through every file,” said Holly. “That’s just not scalable. It’s the difference between paying a bill on time and putting food on the dinner table.”

To grow, Bree needed a better solution that could:

- Eliminate manual reviews to speed up applications and free up team capacity

- Integrate seamlessly with their systems

- Provide instant access to customer financial data

- Enable real-time underwriting powered by insights

That’s when Bree turned to Flinks, not just as a data provider but as a critical part of their tech stack.

{{challenges}}

The fix: Real-time financial data from Flinks

Bree chose Flinks from day one and never looked back. Unlike payday lenders who rely on static pay stubs, Bree uses real-time data to make smarter, more responsible credit decisions.

Flinks Connect is fully embedded in Bree’s onboarding flow. New and returning users connect their bank accounts through Flinks, giving Bree secure, real-time access to financial data. This data plays a critical role in powering a fast, digital experience for customers, removing paperwork, credit checks, and delays.

Bree’s product is built around speed and simplicity. With Flinks integrated into the flow, customers can connect their accounts in minutes and receive funds shortly after, without paperwork or delays.

Flinks’ categorization and the speed of data delivery are critical to Bree’s operations. Customers now complete their application and receive funds in under 10 minutes with no paperwork, no credit checks, and no friction.

In user interviews, the feedback is overwhelmingly positive, highlighting the ease and speed of the experience.

Bree also selected Flinks over other providers due to its strong Canadian coverage, cost-effectiveness, and exceptional customer support.

“Misha (our Relationship Manager at Flinks) is always on call. When I text her, she’s already resolved the issue,” Holly said.

“That level of support has made a huge difference as we’ve scaled.”

{{solutions}}

Faster access, stronger results

With Flinks powering its underwriting, Bree delivers on its promise: fast, inclusive, no-risk access to cash advances when Canadians need it most.

“Flinks saves time, cuts down on manual work, and lets us scale. If we had stayed with the old process, we couldn’t have grown.” — Holly, Chief of Staff at Bree

{{keyoutcomes}}

What’s next for Bree: Scaling impact, not just operations

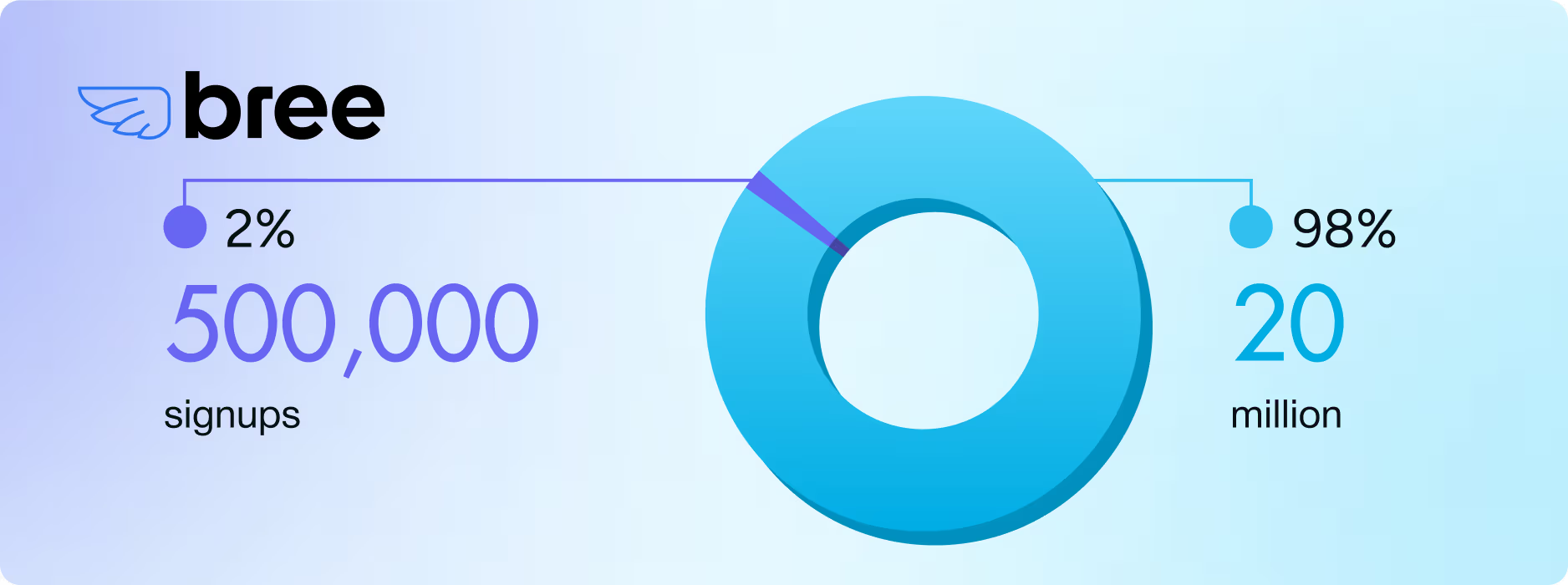

Bree has only scratched the surface of its potential. With over 20 million Canadians still living paycheck to paycheck and over 500,000 signups to date, the opportunity for impact is massive.

In the months ahead, Bree is focused on refining its core product, improving funnel performance, and reducing time-to-money for users. As the company scales, it’s also working to strengthen unit economics through smarter vendor partnerships—Flinks among them.

“We want to do right by more Canadians. And Flinks helps make that possible.” — Holly, Chief of Staff at Bree